In a traditional mortgage scenario, your heirs would be forced to sell the home at a loss and cover the difference. The terms of the LifeStyle Home Loan mandates that neither you nor your heirs are personally liable to cover the difference if your home is sold for a loss. Simply put, it’s not your problem and no one is coming after your estate for a settlement.

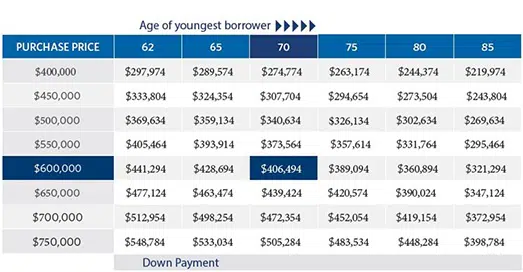

Let’s now take a look at a special Matrix that will give you a snapshot of what’s possible for you using the LifeStyle Home Loan based on your age and purchase price of your new home…

Using the Matrix, the table, match your current age with one of the ages listed along the top row of the chart. For example, let’s say you are currently 70.

If your age is not listed then you can round to the nearest age listed. The next step is to find the expected purchase price of your new home listed along the left hand side of the Matrix and round to the nearest price.

So for this example let’s use a purchase price of $600,000 and an age of 70. You can see that you would only be required to bring a down payment of $406,494 to closing and NEVER make another monthly mortgage payment!